All Pet Insurance Providers in Australia

Choosing the right pet insurance shouldn’t be confusing. Below, you’ll find a clear, easy-to-understand comprehensive table of all pet insurance providers in Australia, helping you see your options at a glance. Whether you’re caring for a playful pup or a curious cat, this list makes it simple to compare what matters most, so you can choose the coverage that best supports your pups health and ensures peace of mind.

What is the Pet insurance table?

The pet insurance table below represent the brief version of the policies offered by the various the pet insurance provider in australia, the data is presented in a tabulated based on these factors, because these pieces of information are the most important ones when it comes to searching through pet insurances.

For a more detailed comparison and list of all the policy covers offered by the below listed pet insurance providers, please visit our compare pet insurance page.

Furbaby Score

This score reflects customer satisfaction, based on thousands of verified reviews from real pet owners. It’s a quick way to see how happy other pet parents are with their insurance experience.

Annual Limit

This shows the range of total coverage available per year. “No sub-limits” means you can use the full limit however you need, without restrictions on specific conditions or treatments.

Benefit Percentage

This percentage tells you how much of your vet bill the insurance will reimburse after any excess is applied. For example, a benefit of 90% means the insurer pays 90% of eligible costs, and you pay the remaining 10%.

Excess

This is the amount you must pay out of pocket each year before your insurance starts covering claims. A lower excess usually means higher premiums, but less upfront cost when you make a claim.

Dental Coverage

Indicates whether dental care-like cleanings, extractions, or treatment for dental disease-is included in the plan. Not all insurance policies offer this, so it’s an important consideration if dental health is a concern.

Extras Benefits or Routine Care

Shows if the policy includes coverage for routine care or additional extras, such as vaccinations, flea treatments, or wellness check-ups. These benefits can help offset the cost of preventive care and keep your pet healthy year-round.

| Provider | Product | Furbaby Score | Annual Limit Options Sub - Limts? | Benefit % Options | Min - Max Excess Excess type | Dental Coverage | Extras or Routine | |

|---|---|---|---|---|---|---|---|---|

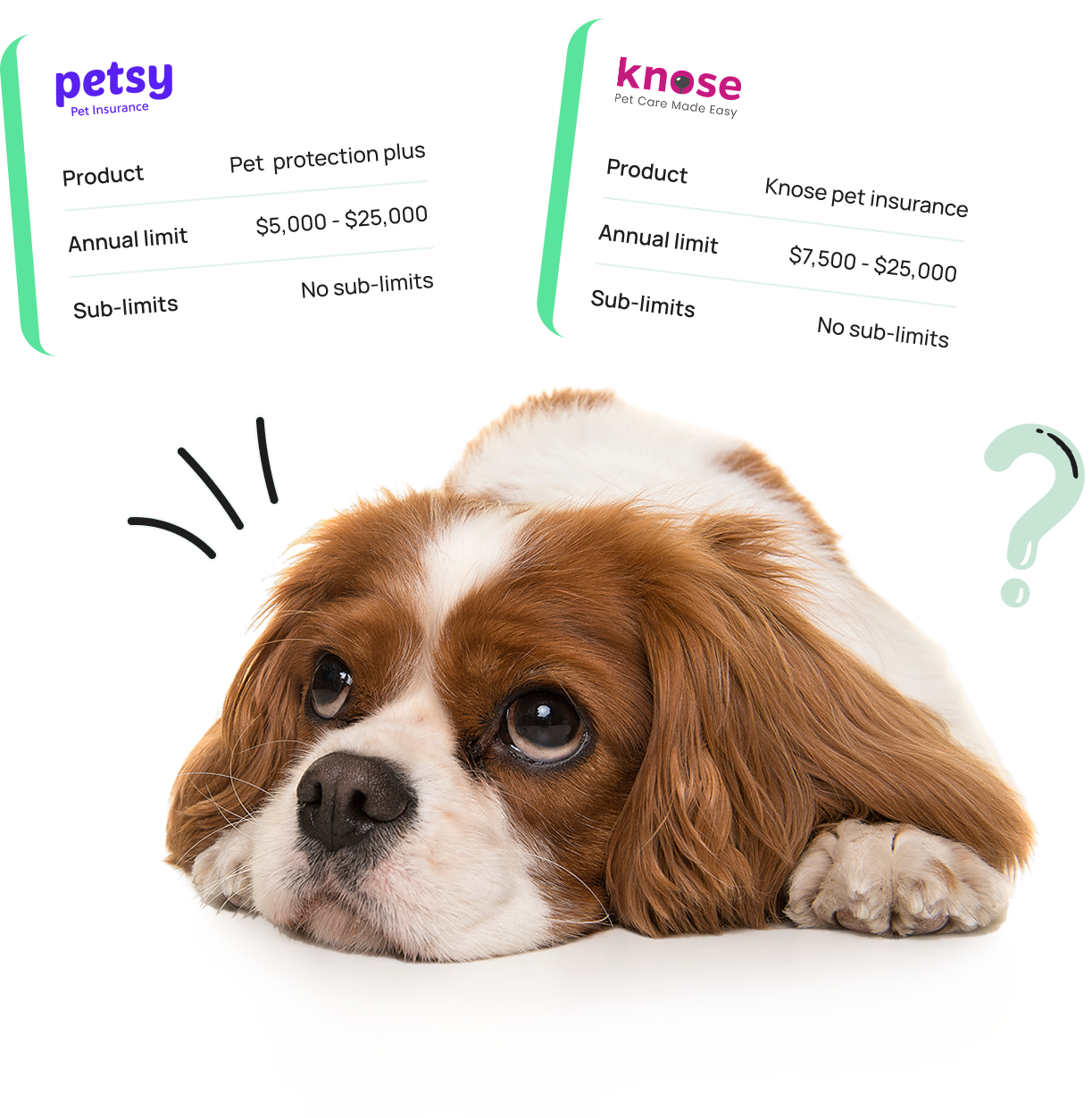

| Petsy Pet Protection Plus | 4.9|467 reviews | $5,000 / $10,000 / $25,000 No sub-limits | 80% / 90% | $0 - $500 Annual excess | Extras Routine | Get a quote | |

| Stella Pet Insurance | 3.5|661 reviews | $7,500 / $12,500 / $20,000 No sub-limits | 70% / 80% / 90% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Knose Pet Insurance | 4.2|808 reviews | $7,500 / $12,500 / $25,000 No sub-limits | 70% / 80% / 90% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Top Accident & Illness Cover | 3.2|382 reviews | $12,000 Sub-limits | 80% | $0 Annual excess | Extras Routine | Get a quote | |

| RSPCA Ultimate Plus Accident & Illness Cove | 3.7|7620 reviews | $20,000 Sub-limits | 80% | $0 Annual excess | Extras Routine | Get a quote | |

| Pet Circle Pet Insurance | 3.6|5869 reviews | $10,000 / $17,500 / $30,000 No sub-limits | 70% / 80% / 90% | $0 - $150 Annual excess | Extras Routine | Get a quote | |

| insurance.com.au Pet Insurance | 3.2|1024 reviews | $5,000 / $15,000 / $25,000 No sub-limits | 70% / 80% / 90% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Fetch Pet Insurance | 3.6|180 reviews | $30,000 No sub-limits | 80% / 90% / 100% | $0 - $500 Annual excess | Extras Routine | Get a quote | |

| Nose-to-Tail Cover | 3.6|4144 reviews | $10,000 / $20,000 / $30,000 No sub-limits | 70% / 80% / 90% | $250 - $500 Annual excess | Extras Routine | Get a quote | |

| Select and Protect Cover | 4.1|2738 reviews | $15,000 / $25,000 / $35,000 No sub-limits | 70% / 80% / 90% | $0 - $600 Annual excess | Extras Routine | Get a quote | |

| Pet Max | 3.7|532 reviews | $30,000 Sub-limits | 90% | $0 - $250 Annual excess | Extras Routine | Get a quote | |

| Basic Care | 3.2|503 reviews | $15,000 Sub-limits | 75% | $0 - $100 Annual excess | Extras Routine | Get a quote | |

| Real Standard Cover | 3.7|430 reviews | $12,000 Sub-limits | 75% | $0 Annual excess | Extras Routine | Get a quote | |

| Gold Cover | 3.5|167 reviews | $20,000 Sub-limits | 80% | $0 Annual excess | Extras Routine | Get a quote | |

| Classic Cover | 0.8|0 review | $15,000 Sub-limits | 70% / 80% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Standard | 4.1|432 reviews | $12,000 Sub-limits | 80% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Basic | 3.3|677 reviews | $5,000 Sub-limits | 80% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Essential | 3.6|302 reviews | $12,000 Sub-limits | 80% | $100 - $200 Annual excess | Extras Routine | Get a quote | |

| Guardian Silver Cover | 3.2|37 reviews | $8,000 Sub-limits | 80% | $0 Annual excess | Extras Routine | Get a quote | |

| Pet Premium | 3.7|68 reviews | $12,000 Sub-limits | 80% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Essential | 3.2|29 reviews | $10,000 / $15,000 No sub-limits | 80% / 100% | $100 - $200 Annual excess | Extras Routine | Get a quote | |

| Total | 3.5|107 reviews | May vary No sub-limits | 100% | $0 Annual excess | Extras Routine | Get a quote | |

| Core | 3.7|1223 reviews | $5,000 / $10,000 / 15,000 No sub-limits | 80% / 90% / 100% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Young Pets | 2.6|73 reviews | $5,000 / $12,000 / 18,000 Sub-limits | 65% / 80% | $0 - $99 Annual excess | Extras Routine | Get a quote | |

| Prime Royal Accident Only Cover | 3.2|53 reviews | $10,000 Sub-limits | 80% | $0 Annual excess | Extras Routine | Get a quote | |

| Pro Cover | 3.8|20 reviews | $12,000 Sub-limits | 80% | $200 - $500 Annual excess | Extras Routine | Get a quote | |

| Basic | 2.5|0 review | $12,000 Sub-limits | 60% / 80% | $0 Annual excess | Extras Routine | Get a quote | |

| Accident & Illness Cover | 4.1|642 reviews | $12,000 Sub-limits | 75% / 85% | $0 Annual excess | Extras Routine | Get a quote | |

| Single core “Illness & Injury” cover | 3.5|36 reviews | $12,000 Sub-limits | 80% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Silver Cover | 3.2|77 reviews | $8,000 Sub-limits | 80% | $0 Annual excess | Extras Routine | Get a quote | |

| Standard | 4.1|172 reviews | $12,000 Sub-limits | 80% | $100 Annual excess | Extras Routine | Get a quote | |

| Core | 3|785 reviews | $5,000 / $10,000 / 15,000 No sub-limits | 80% / 90% / 100% | $0 - $200 Annual excess | Extras Routine | Get a quote | |

| Basic | 3.5|802 reviews | $5,000 Sub-limits | 80% | $0 - $200 Annual excess | Extras Routine | Get a quote |

What is the

Furbaby Score ?

The Furbaby Score looks at ratings across platforms to show satisfaction levels and also tracks how active and recent the reviews are, giving you a sense of how engaged each provider is with their customers. With the Furbaby Score, you can feel more confident in choosing insurance for your pet and your peace of mind.

Steps to Make a Smart Decision

1

Identify your pet's needs

Pets have varying insurance needs based on their age and health conditions. Older pets may require more coverage, while younger pets may need more coverage for accidents.

2

Compare coverage options

Prioritize plans that cover your pet’s specific needs like preventative care, emergencies, and chronic conditions. Carefully read the policy to understand the coverage details.

3

Compare deductibles & premiums

Consider how much you can afford to pay out of pocket for your pet’s care and compare different plans’ deductibles and premiums.

4

Check for exclusions

Make sure to read the policy’s exclusions carefully. Some plans may not cover pre-existing conditions or certain breeds.

5

Compare coverage options

Check the insurer’s reputation and ratings to ensure they provide good customer service and paying out claims in a timely manner.

6

Compare deductibles & premiums

Don’t just settle for the first plan you find. Get quotes from several insurers and compare them side by side to find the best value for your money.

Want to get a deeper in-depth comparison?

Pet insurance comparison involves evaluating and contrasting different policies and providers to find the best option for your pet’s health needs and budget. Factors to consider include coverage options, deductibles, premiums, co-pays, waiting periods, pre-existing conditions, exclusions, and provider reputation. By comparing quotes, coverage options, and reading reviews, you can make an informed decision to protect your pet’s health and well-being.

But, if you are looking for a more detailed breakdown. Visit our compare pet insurance page, which dives deepr into every pet insurance provider and policies, covering things like coverage limits, premiums, deductibles, waiting periods, and exclusions.

Frequently asked questions

Still have a few things you’d like to clear up about pet insurance? We’re here to help!